Email: info@hdfiberglass.com Whatsapp: +86 15200033566

Views: 1 Author: Site Editor Publish Time: 2022-11-28 Origin: Site

1. Price

The recent stabilization and recovery of prices mainly relies on large enterprises taking the lead in active cold repairs and suspending projects under construction and proposed construction. The thinking has changed, hoping to stabilize prices and the market (different from the last round of price war industry reshuffle), but it will disappear in the short term. The difficulty of inventory is still relatively large, and it will take some time to judge the overall price increase. There may be opportunities for individual products (wind power, electronics, etc.) to increase.

2. Demand

The demand for Q4 and next year is prudent. In the short term, some civil composite material factories are gradually entering the stage of shutdown at the end of the year. In the medium and long term, there will still be downward pressure on external demand in 23 years. Domestically, it mainly depends on the restoration of consumer confidence after the epidemic and the stimulation of external policies (judgment will be somewhat slow). The proportion of demand in each sub-sector is roughly 2 million tons for construction, 800,000-1.5 million tons for wind power, 750,000-800,000 tons for electronics, and more than 1.2 million tons for automobiles. It is believed that the future penetration rate of the construction sector has the greatest potential for improvement, especially the thermal insulation market. There are mainly problems such as insufficient market promotion and lack of research and development.

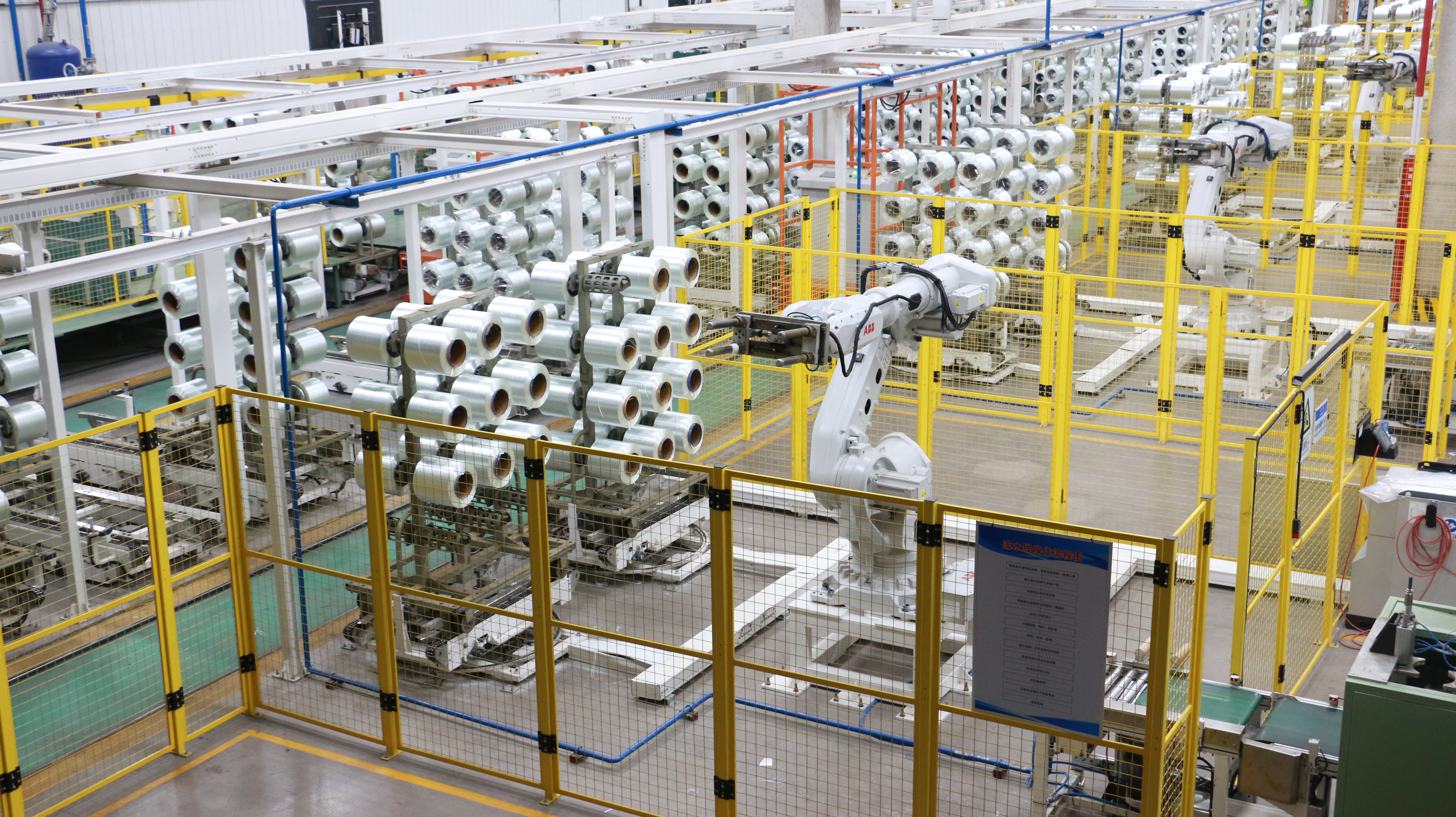

3. Supply

Since 2022, the newly added production capacity is about 600,000 tons. The production capacity in the third and fourth quarters is delayed, mainly concentrated in the hands of the three major glass fiber factories. The total capacity of the current production capacity with ignition conditions is expected to be 500,000 tons, which may be in the next year. Production will start in the first half of the year, so the market will be able to withstand the supply in the first half of next year, and there will be no major problems in the future. The production capacity expansion of leading companies is mainly to ensure the right to speak in the market (low sensitivity to market prosperity and profitability), while second-tier companies will slow down their production expansion when the market is not good, so they are not expected to invest soon.

Is it better to choose emulsion or powder for glass fiber chopped strand mat?

Building Stronger Ships: Application Cases And Technical Advantages of Yuniu Chopped Glass Fiber Mat

Yuniu Fiberglass Chopped Strand Mat - Helping Your Project To Success

Corporate Visual Identity of Hebei HaiDing Fiberglass Manufacturing Co., Ltd.

What does the price increase of fiberglass products (chopped strand mat) mean?

Fiberglass Materials for Electrical Insulation and Electronics Applications